When tangled in the complex web of tax issues, your salvation often lies in the expert guidance of a tax lawyer, a stalwart who navigates the stormy seas of tax law. But before this navigational journey, comes the essential task of preparation, akin to stocking your ship before embarking.

This article will serve as your trusty compass, guiding you through a checklist to optimally prepare for a meeting with a tax lawyer.

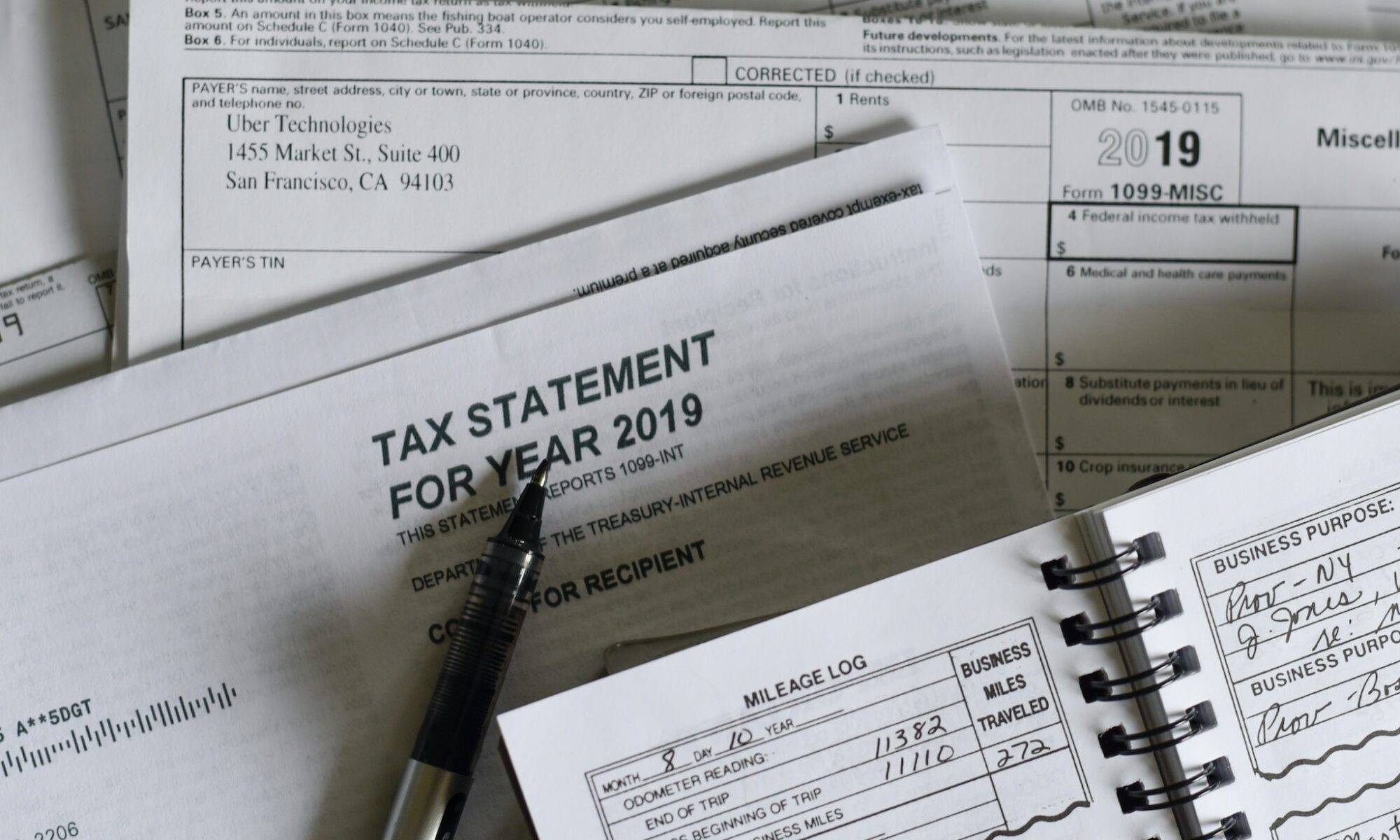

The Captain’s Log: Gathering Essential Documents

Before your rendezvous with a tax lawyer, gathering crucial documents is akin to preparing your ship’s logbook. Tax returns, receipts, invoices, bank statements, pay stubs, and business documents form the vital entries of this log. A comprehensive log enables your tax lawyer, acting as the ship’s captain, to plot the course of your tax situation, and craft expert advice.

Charting the Course: Organizing Your Information

To ensure a fruitful journey with your tax lawyer, organizing your information is as essential as charting the course. An inventory of questions, a timeline of your tax tale, and any pertinent background data make up this course. This preparation allows your tax lawyer to delve into the depths of your situation and tailor advice to your needs.

Setting the Destination: Determining Your Goals

Before embarking on your meeting with a tax lawyer, it’s crucial to know your destination — your goals. Understand your legal commitments, identify looming tax icebergs, and form a strategy to navigate around them. A clear goalpost makes it simpler for the tax lawyer to guide your ship with the best advice.

The Captain’s Background: Researching the Tax Lawyer

Just as a ship’s captain must be trustworthy, so must your tax lawyer. Scrutinizing their credentials, their expertise in tax law, and their reputation through reviews and testimonials are vital steps. This research aids you in finding the right captain for your tax navigation journey.

The Journey Begins: Preparing for the Meeting

As you stand at the precipice of the meeting, diligent preparation ensures smooth sailing. Present yourself appropriately, arrive timely, have your logbook and questions at hand. Being prepared not only displays your seriousness about the tax issue but also shows respect for the tax lawyer’s time.

On the Open Sea: During the Meeting

In the throes of the meeting, transparency and honesty are your guiding stars. Listen intently to your tax lawyer’s advice and record crucial points. The more complete your logbook, the more accurately they can plot the course.

After the Voyage: Post-Meeting

When the meeting concludes, remember that your voyage isn’t over. Follow up with any lingering questions and, if satisfied, consider hiring the tax lawyer. Implement the strategy formed to address your tax issue.

Epilogue

While the prospect of meeting a tax lawyer may feel like stepping into a maelstrom, thorough preparation can turn it into a favorable wind. By gathering documents, organizing your information, setting clear goals, researching the tax lawyer, and preparing for the meeting, you become the master of your journey. During the meeting, transparency, active listening, and note-taking are key. The journey concludes with post-meeting follow-ups and executing the devised plan. This checklist is your trusty compass, steering you towards a productive meeting with your tax lawyer, ultimately leading to a resolution of your tax issue.

As you find yourself embroiled in the intricate lattice of tax law, your beacon of hope often lies in the expertise of a tax lawyer, a stalwart navigator of the tumultuous seas of tax-related matters. Before commencing this voyage, an integral preparatory phase beckons, akin to outfitting your vessel prior to setting sail.

This article stands as your reliable compass, illuminating the pathway with a checklist crafted to assist you in ideally preparing for your consultation with a tax lawyer.

The Ship’s Ledger: Collecting Crucial Documents

Prior to your consultation with a tax lawyer, amassing essential documents parallels the process of preparing your ship’s ledger. Tax returns, invoices, receipts, bank statements, pay slips, and business-related paperwork form the fundamental entries of this ledger. A thorough ledger equips your tax lawyer, acting as the ship’s captain, with the means to chart the course of your tax situation and formulate expert counsel.

Mapping the Route: Structuring Your Information

To ascertain a fruitful engagement with your tax lawyer, structuring your information is as pivotal as laying down the route. An itemized list of questions, a chronology of your tax narrative, and any relevant background information constitute this route. This preparation allows your tax lawyer to delve into the intricacies of your situation and tailor advice that addresses your unique needs.

Determining the Destination: Identifying Your Objectives

Before the commencement of your meeting with a tax lawyer, it’s of essence to understand your destination – your objectives. Comprehend your legal obligations, pinpoint imminent tax obstacles, and devise a strategy to circumnavigate them. Clearly delineated objectives simplify the process for the tax lawyer to steer your journey with the most appropriate advice.

The Captain’s Credentials: Researching the Tax Lawyer

Just as the ship’s captain ought to be trustworthy, so should your tax lawyer. Conducting a thorough evaluation of their credentials, their proficiency in tax law, and their reputation through reviews and testimonials is a necessary step. This investigation assists you in selecting the right captain for your tax-related voyage.

The Voyage Commences: Readying for the Meeting

As you find yourself at the threshold of the meeting, diligent preparation ensures a smooth journey. Arrive punctually, present yourself professionally, and have your ledger and queries ready. Being prepared not only conveys your seriousness about the tax issue but also demonstrates respect for the tax lawyer’s time.

Navigating the Turbulent Waters: During the Meeting

In the throes of the meeting, transparency and honesty serve as your guiding constellations. Attentively listen to your tax lawyer’s advice and make note of critical points. The more comprehensive your ledger, the more accurately they can chart the course.

Post-Voyage: After the Meeting

Upon the conclusion of the meeting, bear in mind that your journey isn’t over. Address any lingering questions and, if satisfied, contemplate retaining the services of the tax lawyer. Implement the strategy devised to tackle your tax issue.

Finale

The prospect of meeting a tax lawyer may seem like venturing into a tempest, but with comprehensive preparation, it can metamorphose into a favorable breeze. By assembling documents, organizing your information, setting lucid goals, researching the tax lawyer, and preparing for the meeting, you transition from being a mere passenger to the master of your journey. Transparency, active listening, and note-taking form the pillars of the meeting. The journey concludes with post-meeting follow-ups and the execution of the outlined plan. This checklist serves as your faithful compass, directing you towards an efficient meeting with your tax lawyer, ultimately leading to the resolution of your tax issue.

FAQ

What’s a tax lawyer?

A tax lawyer is a legal sentinel who specializes in tax law and provides advice on tax labyrinth navigation.

Why prepare for a tax lawyer meeting?

Thorough preparation ensures you reap maximum benefits from your meeting, enabling the tax lawyer to tailor their advice to your needs.

What documents must I carry to a tax lawyer meeting?

Carry all documents related to your tax journey: tax returns, receipts, invoices, bank statements, pay stubs, and business documents.

How to formulate goals for a tax lawyer meeting?

Determine your goals by understanding your legal commitments, identifying potential tax icebergs, and formulating strategies to sail around them.

What are the steps after a tax lawyer meeting?

Post-meeting, address any residual questions, consider hiring the tax lawyer, and execute the devised plan to address your tax issue.