- The Importance of Hiring a Boating Accident Lawyer

Are you an avid boater, or do you enjoy spending your summers out on the water? While boating can be a thrilling and relaxing activity, it’s important to remember that accidents can happen at any time.

- Steps to Take After a Car Accident: Consult an Accident Lawyer

You never expect to be involved in a car accident, but when it happens, it’s important to know the steps you should take.

- Why you need a pedestrian accident lawyer

When it comes to being involved in a pedestrian accident, the last thing on your mind may be seeking legal representation.

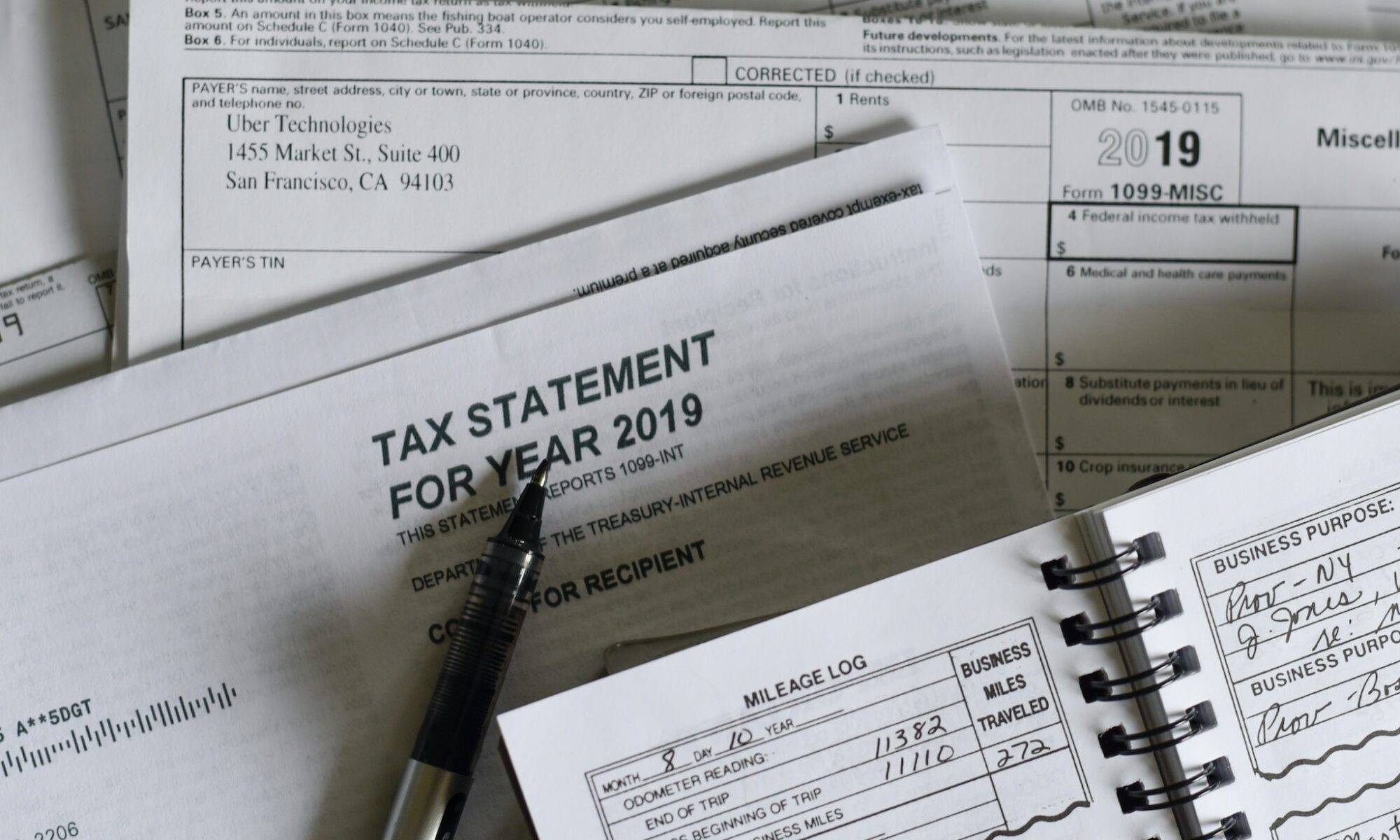

- What to Do After an Uber Accident: A Guide to Hiring a Lawyer

So you’ve found yourself in the unfortunate situation of being involved in an Uber accident. Don’t panic, because help is just a click away!

- How to Find a Skilled Lyft Accident Lawyer

Looking for the right Lyft accident lawyer can be a daunting task, but fear not! This article will guide you through the process, ensuring that you find a skilled attorney who can expertly handle your case. With their knowledge and experience, a skilled Lyft accident lawyer can help you navigate the complexities of the legal system, ensuring that you receive the compensation you deserve. So, if you’ve been involved in a Lyft accident and need legal representation, keep reading to learn how to find the perfect lawyer to assist you in your journey towards justice. Understanding the Importance of Hiring …

Continue reading "How to Find a Skilled Lyft Accident Lawyer"

- 5 Steps to Find the Best Boat Accident Lawyer

If you’ve been involved in a boat accident and need legal assistance, finding the right lawyer to represent you can feel overwhelming. Fortunately, there are five simple steps you can follow to ensure you find the best boat accident lawyer for your case.

- The Importance of Hiring a DUI Accident Lawyer

Imagine being involved in a car accident where the other driver was under the influence of alcohol. You’re left with physical injuries, emotional trauma, and mounting medical bills. In such a situation, hiring a DUI accident lawyer becomes crucial.

- How to Find the Best Bus Accident Lawyer

So you’ve found yourself in a troubling situation where you’ve been involved in a bus accident and now you’re in search of the best bus accident lawyer to handle your case.

- Hiring a Slip and Fall Accident Lawyer

So you’ve had a slip and fall accident, and now you’re wondering if hiring a slip and fall accident lawyer is the right move for you.

- The Best Car Accident Lawyer: How to Find the Right Legal Representation

So you’ve been involved in a car accident, and now you’re faced with the daunting task of finding the right legal representation to protect your rights and ensure a fair settlement.

- The Best Motorcycle Accident Lawyer You Should Hire

Looking for the best motorcycle accident lawyer to represent you in your case? Look no further!

- Hiring a Drunk Driving Accident Lawyer

If you or a loved one has been involved in a drunk driving accident, the consequences can be overwhelming. From physical injuries to emotional trauma, it’s essential to ensure that you have the right legal representation by your side.

- Top Tips for Choosing an Automobile Accident Lawyer

When it comes to choosing an automobile accident lawyer, finding the right one can be a daunting task. With so many options available, it’s important to have some top tips in mind to help guide you in making the best decision for your case.

- How to Choose the Right Drowning Accident Lawyer

If you or a loved one has been involved in a drowning accident, it is crucial to have the right legal representation by your side. The process of choosing the right drowning accident lawyer can be overwhelming, but fear not – we are here to guide you through it.

- Top 5 Reasons to Hire a Work Accident Lawyer

Have you recently experienced a work-related accident? If so, you may find yourself overwhelmed with the physical pain and emotional stress that follows. However, hiring a work accident lawyer can provide you with essential support during this challenging time.