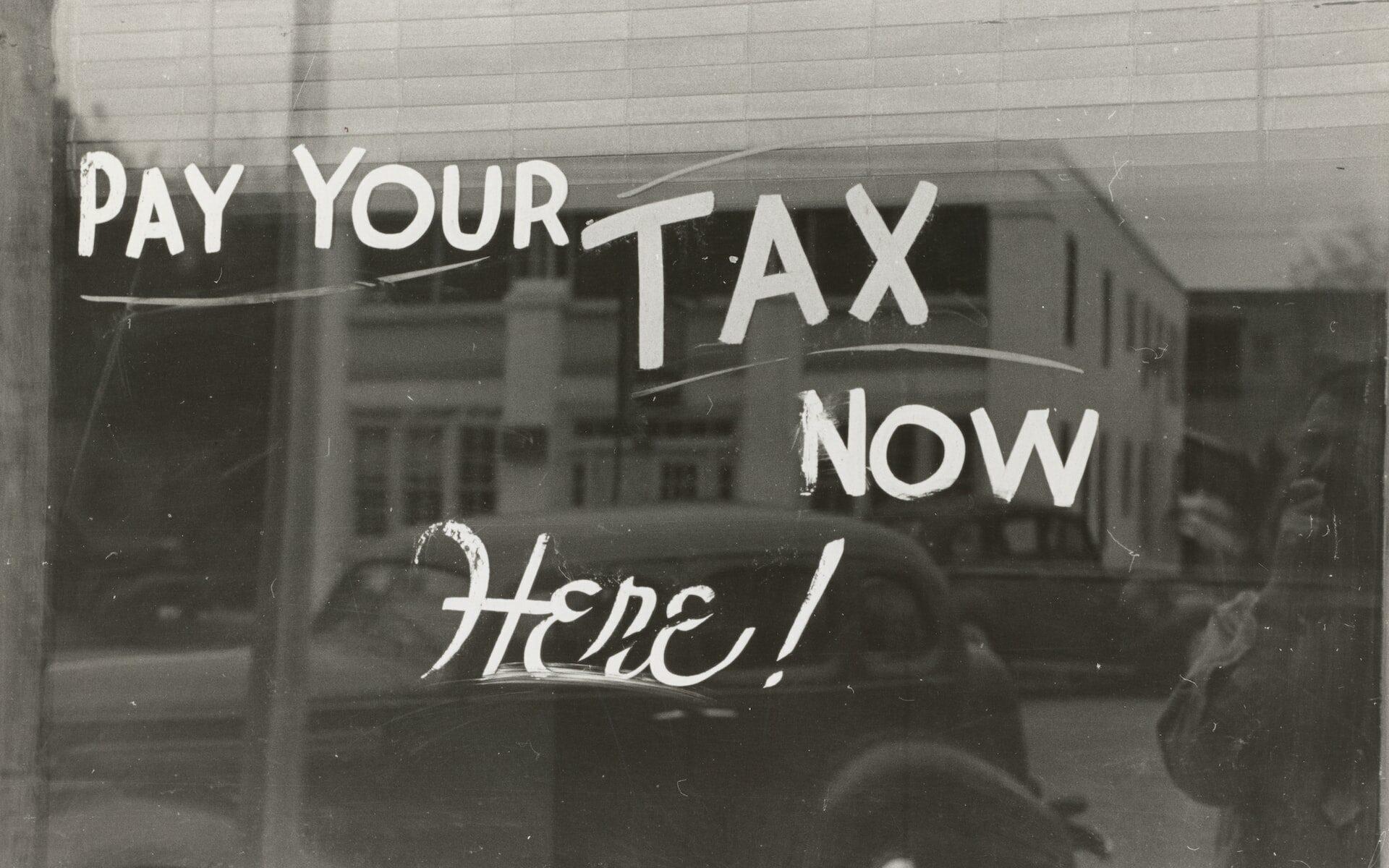

The season of taxes looms large, a specter of dread shrouding many. The reasons? They are as plentiful as they are palpable: a monstrous blend of daunting complexity, scorching stress, and confounding confusion. The gravest of all, however, might be the stark propensity for errors – seemingly minor, potentially catastrophic – that can land you in a labyrinth of legal trouble. Yet, within the gloom, a silver lining gleams: A robust battalion of IRS tax attorneys stands ready to steer your ship through this turbulent tax sea with the least peril.

Before plunging into the maelstrom of tax filing, it’s crucial to wield the weapon of research. Identify the right accountant who can be your beacon through the storm. Navigating the terrain of your finances, they ensure each phase is meticulously handled. As you set out on your hunt for an IRS tax attorney, take these pointers to heart:

- Cost: Firm fees are a complex cocktail of factors. Dig beneath the surface of website quotes. Investigate the necessaries of engagement.

- Expertise: Not all accountants are cut from the same cloth.

An irksome tax filing can be your unsung hero, subtly nudging life towards a smoother trajectory. Kickstart the process by choosing your representative – going solo or employing an IRS tax attorney. Locating one isn’t rocket science; a simple online sweep or a visit to the American Bar Association’s Lawyer Directory or the National Association of Legal Professionals’ (NALP) Professional Roster should suffice. Once you’ve zeroed in on a trustworthy name, initiate an upfront conversation about their estimated timeframe and corresponding costs. Considering your financial situation, this might not be a conversation to shelve – it could safeguard you from hefty future penalties.

When taxes loom large, an IRS tax attorney is your knight in shining armor. If tax doubts cloud your mind, it’s time to call in reinforcements. These legal wizards are armed with the intricacies of tax code, sparing no effort until every question finds its answer. Even the smallest, most elusive detail doesn’t escape their vigilant scrutiny, ensuring your tax affairs are watertight.

A frequently asked question orbits the tax world – Do I need an IRS tax attorney? The response hinges on several factors: the complexity of your returns, your last filing date, and your outstanding tax debts, penalties, or interest. If you answer in the affirmative to any of these, it’s time to consider an IRS tax attorney. The benefits are manifold: peace of mind, time conservation, expert guidance on intricate procedures like estate planning, and assistance with IRS paperwork that may be irrelevant for others.

As an income-earning individual, a tax attorney is your ally. As you embark on your entrepreneurial journey, you might find the IRS assigning you an attorney who will serve as their representative for your tax matters. It’s crucial to remember that an attorney, even when you anticipate no debt, can minimize penalties and interest rates. Be prudent in choosing your email templates, ensuring your message aligns with the recipient’s situation. Also, bear in mind that reaching out too early or too late can be problematic for the attorney.

A simple yet potent strategy to lower your tax liability is attending to your taxes promptly. In doing so, you reduce your dependence on an IRS tax attorney. To aid this, establish an organization system that alerts you about your filing deadlines and requisite documents. This strategy can be a money-saver for small businesses and minimize their need for a tax attorney.

A hectic, costly year might necessitate an IRS tax attorney. Their role can take one of three forms: total process management, only filing the taxes and submitting necessary documents, or providing advice on contentious points. Once your tax requirements are clear, scout for a competent tax attorney who can work in tandem with other consultants to give you the best tax strategy.

Managing taxes can be an uphill battle. Leverage our expertise to ease the ascent. We offer a helping hand through every step and sage advice. Your earnings, whether past or prospective, are immaterial. We value the information you provide – the cornerstone of any complex decision-making process like taxes. Let’s dialogue about your queries or concerns to de-clutter the process. Call us now!

Caught up in the whirlwind of a busy schedule? Stay calm! We at Briggs and Briggs, LLP are here to assist. With two decades of industry experience, we empathize with your situation. Maximize your time before the tax deadline with these tips:

- File Your State Income Tax Form: This process differs from federal tax filing. Complete it promptly to leverage any available deadlines.

- Plan Ahead for Next Year: Don’t wait till you’re swamped with taxes to realize you should’ve planned earlier!